U.S. Customers Have Spent Extra Than $4.1 Billion On Pre-Rolled Joints In The Previous 18 Months and Packaged Flower continues to be #1 Above even Pre-Rolled Flower Joints!

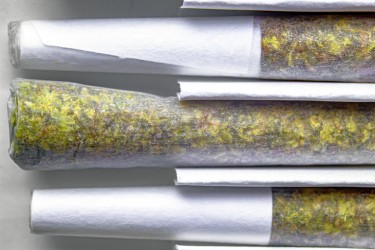

Flower reigns supreme, whether or not shopping for it as buds and flowers or having these buds and flowers pre-rolled into joints for you, smoking hashish continues to be the king in keeping with a brand new trade research!

With buyer tastes altering towards comfort and ready-to-use merchandise, pre-rolled joints have remodeled from a distinct segment product to a retail mainstay, shortly changing into one of many hashish trade’s fastest-growing segments.

In accordance with a current research, pre-rolls witnessed the best rise in gross sales earnings throughout all product classes from June 2023 to June 2024, rising by 11.89%.

This evaluation found that pre-rolls produced greater than $4.1 billion in gross sales, with over 394 million models offered throughout that point interval.

Customized Cones USA, a Renton, Washington-based pre-roll packaging and manufacturing firm, and Headset, a hashish trade analytics group headquartered in Seattle, carried out the analysis.

“High quality has continued to extend, and costs proceed to drop,” mentioned Harrison Bard, co-founder and CEO of Customized Cones USA and DaySavers.

Adam Coates, chief income officer at Decibel Hashish Co., primarily based in Calgary, Alberta, and producer of Canada’s top-selling pre-roll model, Normal Admission, credited pre-rolls’ rising reputation to customers’ need for fast gratification.

“Comfort codecs are beginning to take maintain,” Coates famous. “That’s why pre-rolls are rising, and also you’re additionally seeing related tendencies in different classes like all-in-one vapes.”

Main the Pack in Recognition and Gross sales with Infused Pre-rolls

Infused joints, which turned the main pre-roll class within the U.S. final 12 months, have persistently held a median 43.4% share of the market in areas tracked by Headset.

Within the first half of 2024, infused pre-rolls captured a 44.4% market share, indicating a rising shopper choice for premium merchandise.

In accordance with the Customized Cones USA research, infused pre-roll gross sales exceeded $1.75 billion in 2023 and the primary half of 2024, surpassing hybrid and single-strain pre-rolls, which generated $1.64 billion in gross sales throughout the identical interval.

Gross sales of Normal Admission infused pre-rolls surged in 2022 after Well being Canada clarified regulatory language. Beforehand, laws have been interpreted to ban combining two hashish courses, like dried flower and extracts, right into a single product, which restricted infused pre-rolls.

“Our main product line – and what established our market place – is distillate-infused pre-rolls,” mentioned Adam Coates, chief income officer of Decibel Hashish Co. “We noticed their success in U.S. markets like Colorado, California, and Oregon. Excessive-potency pre-rolls with added terpenes match what customers need.”

In accordance with Jeeter CEO Sebastian Solano, non-infused pre-rolls usually dominate new markets, accounting for 70%-90% of gross sales. Nonetheless, “as soon as Jeeter enters the market, infused pre-roll gross sales improve,” Solano mentioned. “In some markets, they develop to 70%.”

Customized Cones USA’s Harrison Bard famous that whereas many customers search the best efficiency attainable, elements like freshness, terpene profile, and cannabinoid content material additionally play a job, particularly for these managing nervousness. “Efficiency isn’t all the things,” Bard defined. “It’s simply one among many elements.”

Some customers prioritize value, an area the place Michigan-based Dragonfly excels. “As states open up and costs fall, high quality hashish turns into extra accessible,” mentioned Ching Ho, founding father of Dragonfly, which claims a 90% share of Michigan’s wholesale pre-roll market. “We transfer extra pre-rolls month-to-month in Michigan than the New York market does in a 12 months.”

With plans to enter the New York market, Ho emphasised Dragonfly’s value-driven strategy: “We provide a high-value product at one of many lowest costs,” Ho mentioned. Dragonfly’s non-infused pre-rolls promote for $1, and infused choices for $3, because of in-house hashish manufacturing. “It’s like Costco’s rotisserie chickens,” Ho famous. “Proudly owning our manufacturing permits these costs.”

Multipack Pre-Rolls: Inexpensive, Handy, and More and more Well-liked

Pre-packaged multipacks of pre-rolls, containing two or extra joints, are gaining traction as a result of their affordability and comfort. They provide price financial savings for each producers, who scale back packaging and labor bills, and customers, who profit from buying a number of joints directly.

In accordance with the Customized Cones USA-Headset research, multipacks held a 27.7% share of the pre-roll market in 2018, a determine that has surged to just about 50% as of June.

Multipack income rose by 43% in simply 18 months, growing from $89.1 million in January 2023 to $127.4 million in June.

“Joints was extra of an add-on,” mentioned Harrison Bard of Customized Cones USA. “Now customers are purchasing particularly for pre-rolls.”

Bard famous that multipacks mirror model loyalty, with many customers opting to stay with the identical product all through the week. Some manufacturers even supply multipacks with varied strains or focused results.

Whereas the 1-gram pre-roll stays the most well-liked choice, smaller quarter-gram “dog-walker” joints are additionally on the rise in reputation.

Pre-Rolls Make Hashish Extra Accessible… Interesting to New Customers

In accordance with the research, pre-rolls rank because the third-largest class, following flower and vape pens, each of which noticed modest development of beneath 3.5%.

Pre-rolls are prone to hold gaining market share as a result of they’re simpler to eat than flower, which requires grinding and both rolling right into a joint or utilizing a separate smoking machine, famous Adam Coates.

Pre-rolls additionally appeal to newer customers who could also be unfamiliar with marijuana however are curious to attempt it.

“Breaking apart flower and rolling a joint isn’t very approachable,” mentioned Jeeter’s Sebastian Solano. “True fanatics love seeing the flower they’re smoking and benefit from the ritual concerned.”

High quality and Freshness Drive Evolution within the Pre-Roll Market

Within the early days of marijuana legalization, customers typically averted pre-rolls because of the low-quality hashish used to fill them. Nonetheless, as pre-roll high quality has improved, customers at the moment are prioritizing freshness, defined Harrison Bard.

Though eco-friendly paper and cardboard packaging have been initially widespread, they’re more and more being changed by containers designed to maintain hashish from drying out. Producers are even beginning to use humidors to take care of freshness, and Bard predicts that humidors may quickly change into a fixture within the properties of frequent hashish customers.

Whereas cigar humidors usually have angled cabinets for show, hashish humidors require flat cabinets, famous Bard, including that Customized Cones USA lately started providing humidors particularly designed for pre-rolls.

Bard additionally anticipates that producers will begin including “best-by” dates to pre-roll packaging and should supply to take again unsold pre-rolls previous this date or promote them at discounted shops.

To fulfill shopper demand for freshness, pre-roll firms might want to enhance provide chain administration and demand forecasting. In a aggressive market, firms could produce hundreds of pre-rolls each day with out promoting them shortly, Bard famous.

“Hashish isn’t as dangerous as gasoline station sushi, however shopper expectations are excessive, and so is competitors,” Bard mentioned. “Manufacturers that may assure freshness by marking manufacturing dates and taking again older merchandise will stand out available in the market.”

Backside Line

The pre-roll hashish market has change into a dominant power within the trade, fueled by shopper demand for comfort, selection, and premium choices like infused joints. With gross sales pushed by improvements in high quality, affordability, and multipack choices, pre-rolls now stand as a top-selling product section. As manufacturers improve freshness and shelf-life administration, pre-rolls are poised to take care of strong development, interesting to each new and skilled hashish customers looking for accessible, ready-to-use merchandise.