In a big growth for the burgeoning hashish business, the U.S. Census Bureau has reported that states throughout the nation have collectively amassed over **$9.7 billion** in tax income from marijuana gross sales since mid-2021. This determine underscores the financial affect of legalized hashish and highlights the rising acceptance of marijuana as each a leisure and medicinal substance in varied states. As extra states transfer towards legalization, the monetary implications each constructive and damaging have gotten more and more evident.

The Panorama of Hashish Legalization

The journey towards hashish legalization in the US has been lengthy and sophisticated. Initially criminalized within the early twentieth century, hashish started to regain acceptance within the late twentieth century, significantly for medical use. The primary state to legalize medical marijuana was California in 1996, setting a precedent that many states would observe.

By 2012, Colorado and Washington turned the primary states to legalize leisure hashish, paving the way in which for a wave of legalization efforts throughout the nation. As of now, greater than 20 states have legalized leisure marijuana, whereas over 30 states enable medical use. This shift displays altering public attitudes towards hashish and recognition of its potential advantages.

Financial Implications of Legalization

The legalization of hashish has not solely reworked social norms however has additionally created a considerable financial affect. States which have embraced legalization have seen important will increase in tax income, job creation, and funding alternatives.

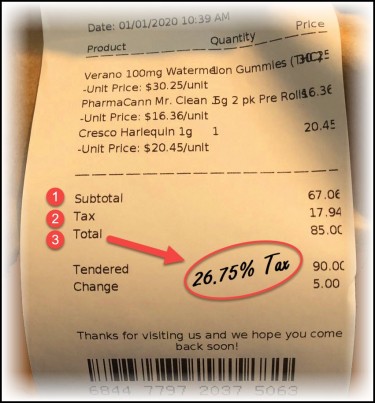

In accordance with the most recent Census Bureau report, states like California, Colorado, Illinois, and Michigan have emerged as leaders in hashish tax income era. These states have applied varied tax constructions on marijuana gross sales, together with excise taxes, gross sales taxes, and native taxes. The income generated is usually earmarked for important public providers equivalent to schooling, healthcare, infrastructure enhancements, and drug rehabilitation packages.

Breakdown of Tax Income by State

As the biggest authorized hashish market in the US, California has been on the forefront of marijuana tax income era. Since mid-2021, California has contributed roughly $2.5 billion to state coffers from hashish taxes. This income is derived from each leisure and medical marijuana gross sales.

California’s tax construction features a 15% excise tax on retail gross sales, together with native taxes that may range considerably by metropolis and county. The state has allotted a portion of those funds to numerous packages geared toward addressing points associated to drug abuse and public well being.

Colorado was one of many pioneers in hashish legalization and continues to function a mannequin for different states. Since mid-2021, Colorado has generated round $1.8 billion in tax income from marijuana gross sales. The state imposes a 15% excise tax on wholesale marijuana transactions and a 2.9% gross sales tax on retail gross sales.

The income generated from hashish taxes has been instrumental in funding schooling initiatives via the Public Faculty Fund, in addition to supporting psychological well being packages and substance abuse remedy providers.

Illinois has seen exceptional development in its hashish market since legalizing leisure use in January 2020. In simply two years, Illinois has collected roughly $1 billion in tax income from marijuana sales. The state imposes a tiered excise tax based mostly on the efficiency of the product, starting from 10% to 25%.

The funds collected are allotted to numerous initiatives, together with neighborhood reinvestment packages geared toward addressing social fairness points associated to previous drug enforcement practices.

Michigan’s hashish market has additionally flourished since legalization. Since mid-2021, Michigan has generated about $700 million in tax income from marijuana gross sales. The state’s tax construction features a 10% excise tax on leisure marijuana and a 6% gross sales tax.

The income is utilized for varied functions, together with schooling funding and help for native governments impacted by legalization.

Broader Financial Impression

The legalization of hashish has led to important job creation throughout varied sectors. In accordance with business studies, the authorized hashish market helps a whole lot of hundreds of jobs nationwide—from cultivation and processing to retail and distribution. As extra states legalize marijuana, this development is predicted to proceed.

With the expansion of the authorized hashish business comes elevated funding alternatives. Entrepreneurs are coming into the market at an unprecedented fee, resulting in improvements in product growth, advertising methods, and distribution channels. This inflow of funding not solely advantages particular person companies but additionally stimulates native economies.

Social Fairness Concerns

Whereas the monetary advantages of hashish legalization are clear, it’s important to deal with social fairness points that come up alongside this new business. Many states have acknowledged that communities disproportionately affected by previous drug enforcement insurance policies ought to profit from legalization efforts.

States like Illinois have applied neighborhood reinvestment packages that allocate a portion of hashish tax revenues to help communities impacted by earlier drug legal guidelines. These funds can be utilized for schooling initiatives, job coaching packages, and psychological well being providers—aiming to rectify historic injustices related to hashish prohibition.

Along with monetary help for communities affected by previous insurance policies, some states are additionally working to create equitable licensing alternatives for people from these communities. By prioritizing purposes from minority-owned companies or these instantly impacted by earlier drug legal guidelines, states can foster a extra inclusive hashish business.

Challenges Forward

Regardless of the numerous progress made via legalization efforts, challenges stay on each state and federal ranges.

Federal Legalization Uncertainty

One main hurdle is the continuing battle between state and federal legal guidelines relating to hashish. Whereas many states have legalized marijuana for leisure or medical use, it stays categorized as a Schedule I substance below federal regulation. This discrepancy creates issues for companies working legally on the state stage however going through potential federal prosecution.

Efforts towards federal legalization or decriminalization have gained traction not too long ago; nonetheless, progress stays gradual resulting from political divisions and differing opinions on drug coverage reform.

Regulatory Hurdles

As extra states enter the authorized hashish market, regulatory frameworks should evolve to make sure client security whereas selling truthful competitors amongst companies. States face challenges associated to product testing requirements, labeling necessities, promoting restrictions, and taxation insurance policies that may affect market dynamics.

Conclusion

The U.S. Census Bureau studies that states have collected over $9.7 billion in marijuana tax income since mid-2021, highlighting the numerous financial affect of hashish legalization. As public acceptance grows, extra states are prone to pursue legalization. Regardless of ongoing challenges, together with federal rules and social fairness points, legalized hashish is poised to stay an important a part of state economies. Collaboration amongst authorities officers, enterprise leaders, and neighborhood advocates might be important for fostering an equitable and sustainable hashish business. This evolving panorama not solely presents financial development alternatives but additionally addresses historic injustices tied to drug coverage enforcement, shaping the way forward for hashish laws within the U.S.